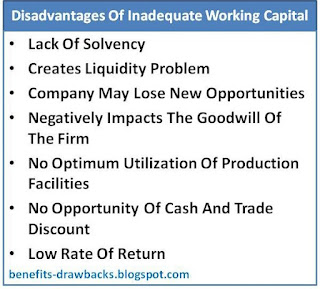

Major drawbacks or disadvantages of inadequate working capital can be highlighted as follows:

1. Lack Of Solvency

Inadequate working capital creates problem for making payment of salary, wages and short-term liabilities of a firm. It weakens the solvency position of the company.

2. Liquidity Problem

A firm cannot maintain proper liquidity because of the shortage of working capital.

3. Opportunity Loss

A business firm may lose new opportunities due to insufficient amount of working capital. Business expansion is also impossible.

4. Damage Goodwill

A firm fails to meet its financial obligations due to inadequate working capital. It affects or damages the goodwill of the firm.

5. Inefficiency

A firm cannot utilize its fixed assets and other production facilities effectively because of the shortage of fund. So, production process will be disturbed and leads to inefficiency.

It is impossible to purchase raw materials and other requirements in bulk quantity because of poor liquidity. So, opportunity of trade discount and cash discount cannot be availed.

Also Read:

7. No Attraction Of Investors

A firm cannot attract investors and lenders due to poor liquidity and solvency position.

8. Low Rate Of Return

Due to inadequate amount of working capital, a firm cannot function properly. It leads to low rate of return on investment.