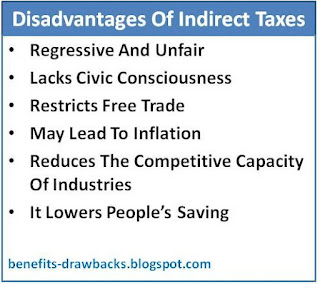

Major drawbacks or disadvantages of indirect taxes are as follows:

1. Unfair/Regressive

Both rich and poor people have to pay same amount of tax because taxes are included in the price of the products and services. So, poor people have to may more amount of their income as tax. So, indirect taxes are regressive and unfair in nature.

2. No Civic-consciousness

Tax payer does not feel the burden of taxes as they are wrapped in the purchase price. So, it lacks civic-consciousness.

3. Restrict Free Trade

Free trade may be restricted due to high export and import duties.

Also Read:

Higher tax rate increases the price of the products which may lead to inflation.

5. Harmful To Industries

Cost of production will be high if raw materials and machinery are highly taxed. It reduces the competitive capacity of industries.

6. Burden For Poor People

Indirect taxes reduce the saving capacity of poor people. So, these taxes are not suitable for households and low-income groups.