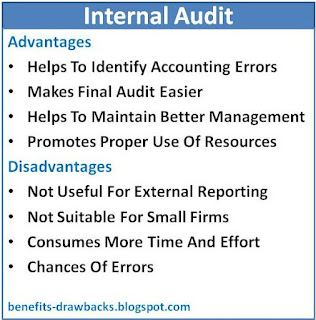

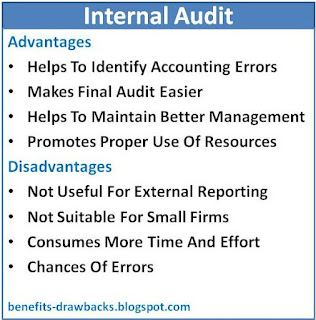

Merits/Benefits Or Advantages Of Internal Audit

The main advantages of internal audit can be highlighted as follows:

1. To Discover Errors And Frauds

One of the main benefits of internal audit is that helps to discover accounting errors and frauds so that they can be rectified before the final audit.

2. To Maintain Proper Accounting

It helps to maintain proper accounting system in the organization. It ensures accuracy and authenticity of accounting records.

3. Provides Base For Final Audit

Internal audit examines and verifies entire books of accounts and locate mistakes and frauds. So, conduction of final audit becomes easier.

4. Increase Employees Efficiency

Internal audit alerts the staffs by checking their performance regularly. It helps to increase their efficiency and also helps to minimize errors.

Internal audit ensures proper utilization of resources by detecting their misuse. It helps to increase operational efficiency and productivity.

6. Valuable Suggestions

It gives suggestions and instructions regarding the financial and operational activities of the organization. So it helps to maintain better management, proper supervision and effective control.

Disadvantages/Drawbacks Or Demerits Of Internal Audit

Some of the notable disadvantages of internal audit can be highlighted as follows:

1. Not Suitable For Small Firms

Internal audit is not suitable for small business organizations with less financial and operational activities.

2. Not Acceptable

It is conducted for internal purpose only. It is not accepted by shareholders and other external users.

Also Read:

3. Chance Of Errors

There may be a chance of errors because of the poor knowledge of the audit staff.

4. Time Consuming

It takes a long time to perform internal auditing. It may disturb regular office work.

Pros And Cons Of Internal Audit In Short

Pros:

- It detects frauds, mistakes and loopholes in the accounting system

- It makes easier to conduct final audit

- It helps to improve operational efficiency

- It provides useful information and suggestions to the management

- It is suitable for big business organizations

Cons:

- It is not useful for external reporting

- It consumes more time and effort which may hamper routine activities in the firm

- It is not suitable for small organizations having limited number of financial activities

- It may lack accuracy because of limited knowledge of internal audit personnel