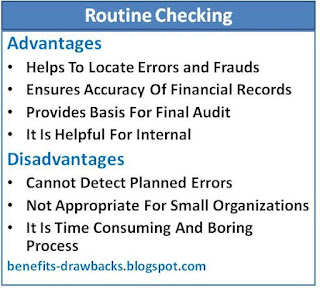

Benefits Or Advantages Of Routine Checking

The main advantages of routing checking can be described as follows:

1. Detection Of Errors

Routine checking involves the examination of debit and credit totals, ledger postings and account balances. Books of accounts are carefully checked so that errors and frauds can be easily located.

2. Arithmetical Accuracy

As we know that it discovers errors and frauds in the books of accounts, it helps to correct mistakes quickly and maintain records up-to-date. So, routine checking ensures arithmetical accuracy of financial records.

3. Basis For Final Audit

All the records and books of accounts are already examined which saves time and labor of auditor while conducting final audit. So, it is a basis for final audit.

4. Simple And Easy

It is a very simple task that can be carried out by a staff having the knowledge of simple accounting rules. So, it is very easy to conduct routine checking job.

Also Read:

Also Read:

5. Internal Control

Routine checking is a regular process that shows recording of transactions and operational efficiency of the firm. So, it helps the management for internal control.

Drawbacks Or Disadvantages Of Routine Checking

The main disadvantages of routine checking can be described as follows:

1. Planned Errors

It discovers only some small and unplanned errors occurred in the books of accounts. Planned errors and frauds cannot be disclosed by routine checking. It is very difficult to locate errors of principle and compensating errors by conducting routine checking.

2. Not Useful For All Business

It is not useful for those firms which apply self-balancing system. Routine checking is not appropriate for small firms with limited number of transactions.

3. Not Reliable

It is carried out by junior staff. There is a chance of carelessness at work. So, its result may not be reliable.

4. Monotonous

It is time consuming and monotonous process. Accounting staff may get bored and lose interest in his/her job.

Pros:

- It ensures arithmetical accuracy of records in original entries

- It helps to discover errors and frauds in the books of account

- It is helpful for conducting final audit

- It requires less cost, time and effort to conduct routine checking

Cons:

- It cannot discover planned errors and frauds

- It is boring and monotonous process

- It is not suitable for small business firms having limited volume of financial activities