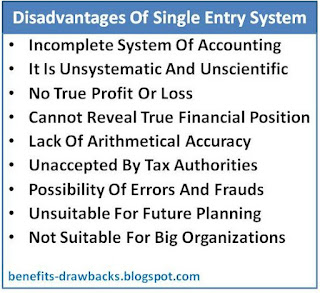

Major drawbacks or disadvantages of single entry system of bookkeeping can be expressed as follows:

1. Incomplete System Of Accounting

Single entry system ignores dual aspects (debit and credit) of transactions. It also ignores nominal account and real accounts. So, it is an incomplete system of recording transactions.

2. Unsystematic And Unscientific System

Single entry system does not follow proper accounting rules and principles to record the financial transactions. So, it is unsystematic and unscientific system of recording transactions which cannot be taken as authentic source.

3. No True Profit Or Loss

Trial balance, trading account and profit and loss account cannot be prepared with the help of single entry system. So, correct profit or loss amount cannot be obtained in the absence of these account.

4. No True Financial Position

Balance sheet cannot be prepared with the help of single entry system because it ignores real accounts. So, true financial position of the firm cannot be revealed in the absence of balance sheet.

Also Read:

Also Read:

5. No Arithmetical Accuracy

This system ignores debit and credit principles of accounting. So, the trial balance cannot be prepared with only one aspect of transaction. Therefore, arithmetical accuracy is not possible in the absence of trial balance.

6. Unacceptable To Tax Authorities

Because of incompleteness, unscientific and lack of accuracy, tax authorities and other business agencies do not rely on single entry system.

7. Chance Of Fraud And Errors

There is very high chance of occurrence of frauds and errors under single entry system because of lack of proper internal check system.

8. Unsuitable For Planning And Control

Single entry system does not provide accurate and adequate information to the management. So, it does not support top level management for future planning and effective control.

9. Not Suitable For Large Business Firms

Single entry system is not suitable for large business firms having large number of financial transactions.