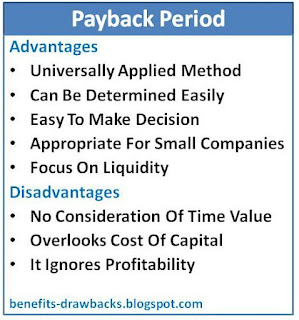

Advantages Of Payback Period (PBP)

Main benefits or advantages of payback period method of evaluating investment proposal are as follows:

1. Simplicity

Payback period method is very simple to understand. It does not require specific knowledge and accounting rules to apply. So, it is universally applied method of evaluating proposals.

2. Easy To Calculate

Payback period is very easy to calculate. It can be determined by using simple formula given below:

Payback Period (PBP) = Investment/Annual Cash Flow

3. Easy To Make Decision

It is easy to select the suitable project with the help of payback period. The project with lowest payback period is selected and the project with longest payback period is rejected.

4. Suitable For Small And New Companies

Payback period method of evaluating investment proposals is suitable for small companies and new companies with less cash in hand or weak liquidity position.

5. Focus On Risk

This method emphasis on the risk factor. So, it is appropriate for those firms who do not take risk.

6. Emphasis On Liquidity

Disadvantages Of Payback Period (PBP)

Major drawbacks or limitations of payback period method of evaluating proposals are as follows:

1. Ignores Time Value Of Money

Payback period method does not consider the time value of money. It is one of the major drawbacks of this method.

Also Read:

2. Ignores Profitability

This method focuses on liquidity and speedy recovery of investment but completely ignores profitability.

3. Ignores Cash Flow After PBP

This method gives emphasis on the cash flow before payback period. It does not consider the cash flow after payback period.

4. Overlooks Capital Costs

Payback period method focuses on the cost of capital only. It ignores interest factor.