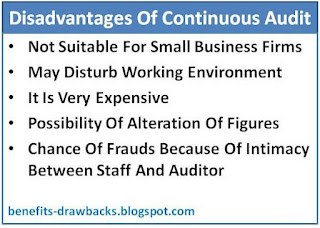

Main disadvantages or limitations of continuous audit can be expressed as follows:

1. Not Suitable For Small Business

One of the major drawbacks of continuous audit is that it is not suitable for small business firms having less numbers of financial transaction.

2. Inconvenience

It may disturb the working environment of the organization because of the frequent surprise visits of audit staffs. So, it is inconvenience system of audit.

3. High Expenditure

Continuous audit is very expensive form of audit because company has to pay high amount of audit fee frequently.

There exists the chance of alteration of accounting figures after checking by the auditor. Alteration may be happened intentionally or unknowingly.

Also Read:

Also Read:

5. Increased Dependency

Because of frequent auditing, client's staff becomes more dependent upon auditor's staff for simple problems and errors.

6. Staff Intimacy

Continuous audit establishes intimacy among the staff and auditor. This intimacy may lead to frauds.