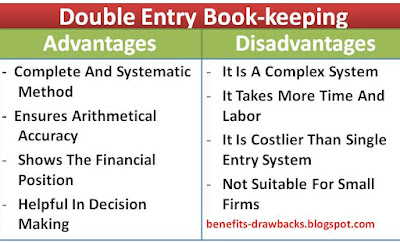

Advantages/Merits/Benefits Of Double Entry System

Major advantages of double entry bookkeeping system can be highlighted as follows:

1. Systematic And Scientific Method

Double entry book-keeping is scientific and systematic system of recording the financial transactions of the business. It is guided by specific rules, principles and techniques.

2. Complete System Of Accounting

Double entry system records both aspects (debit and credit) of each transaction. So, it is a complete system of book keeping.

3. Suitable For Large Companies

It is suitable for large business companies with large volume of financial transactions and resources.

4. Ensure Arithmetical Accuracy

Trial balance is prepared under double entry system. Therefore, it ensures arithmetical accuracy of accounting records.

5. To Obtained Profit Or Loss

Profit or loss of a company can be obtained by preparing profit and loss account at the end of the accounting period.

6. To Know The Financial Position

Balance sheet is prepared at the end of the year. It helps to know the actual financial position of the business.

7. Helps Decision Making

Double entry system provides provides financial data, profit, loss and financial position of the business firm. So it helps the management to take appropriate decision for the betterment of business.

8. Comparison Of Results

Financial results of current year can be compared with the result of previous year which helps the management for future planning.

The main drawbacks or disadvantages of double entry book-keeping system can be pointed out as follows:

1. Complex System

Double entry book-keeping is complex system of recording the financial transaction of business. It requires complete accounting knowledge to maintain the books of accounts. It is not easy to understand this method of accounting.

Also Read:

2. Time And Cost Consuming

It requires more time to record financial transactions in the books of accounts. It requires more money to install and maintain double entry book-keeping in the organization. So, it consumes more time, money and effort as compared to single entry system.

3. Unsuitable For Small Firms

Double entry system is nor suitable for small business organizations having less number of financial transactions and resources.